Selecting a dental implant lab in China is not simply a matter of chasing the lowest price. For sustainable collaboration and predictable clinical outcomes, decision-makers need to assess a set of core dimensions that directly affect quality, efficiency, and trust.

Key evaluation factors include:

Taken together, these criteria help buyers determine whether a partner lab can consistently deliver across case volume, complexity, and time. The goal is not only lower unit cost, but also higher predictability, reduced chairside adjustment, and durable clinical success.

Successful implant work depends on proof of consistent outcomes, not promises. Before you choose a lab in China, look for hard signals: a traceable remake rate by category, a documented QC flow tied to device records, verified use of genuine components, and workmanship that stays stable as volumes grow. For governance baselines, confirm the lab aligns with ISO 13485.

Dental-implant-lab-qc-station

Remake rate shows process capability and where variation hides. Break it down by cause (fit, contact, occlusion, shade, screw seating) and by stage (pre-ship vs. post-seat) so you can act on it. Use a rolling 3–6-month trend with clear definitions of “remake” vs. “adjustment,” and track CAPA closure time by category.

A robust QC maps to medical-device recordkeeping: device master records and device history records that tie work orders, material lots, and acceptance criteria to each case. Ask how criteria are written, who signs off, and where records live. For reference language, see 21 CFR 820 — DMR and DHR. eCFR

Use identity you can verify.

An independent two-op clinic in Brisbane piloted 20 posterior implant crowns over six weeks. Early cases showed inconsistent proximal contacts after sintering. We tightened the shared case form (contact targets, margin notes), added a second in-process check after staining, and locked a tooling set for these prescriptions. Adjustments fell from ~30% to ~10% by week four; no remakes in the final eight cases; chairside time per seat dropped ~12 minutes. As an overseas dental lab, we keep a single spec sheet per implant system so both teams speak the same shorthand.

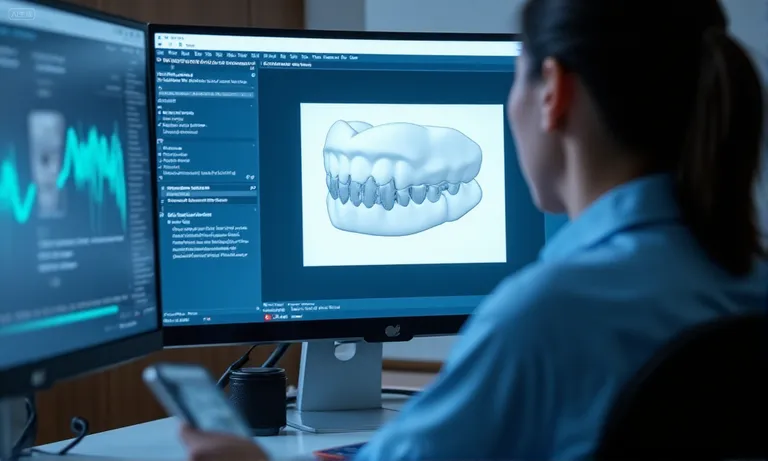

Smooth collaboration comes from two things: matching file ecosystems and shared, real-time communication habits. Before onboarding a Chinese implant lab, confirm open-format support (color where needed), test live response channels, and require simple, versioned workflow docs that your team can follow without extra calls.

Digital-workflow-implant-lab-collaboration

For crowns and abutments, insist on open formats your team can audit and re-use. STL is universal but monochrome; PLY (and sometimes OBJ) retains color/texture for soft-tissue and scan-body detail; vendor-native DCM remains useful inside 3Shape. Check that your lab can ingest and export all three. See 3Shape’s notes on TRIOS exports (STL/DCM/PLY) and exocad’s supported meshes. For a quick primer on when STL vs PLY matters, review this file-format explainer from iDD: Understanding STL, PLY, OBJ. support.3shape.comwiki.exocad.comInstitute of Digital Dentistry

Run a timed “day-zero” drill before the first live case.

Documentation prevents silent rework. Ask for a one-page “how we run implant cases” that includes: intake checklist (scan quality thresholds, scan-body IDs), file conventions (case ID, version tags), decision points (abutment parameter table), and a change log. Keep it versioned and linkable in your case thread. When teams rotate, this single page preserves context and cuts cycle chatter. As an overseas dental lab, we keep a living “case recipe” per implant system so your team sees the same defaults we manufacture against.

Trust in a dental implant lab begins with proof of compliance, not verbal assurance. A qualified partner can show valid ISO certification, clear FDA/CE evidence for relevant devices and materials, and documented workflows aligned with those standards. These credentials should be current, independently verifiable, and mapped to both materials and processes.

Dental-lab-certification-display

Each certification covers different ground. ISO 13485 demonstrates the lab’s quality management system is aligned with medical device manufacturing. FDA registration ensures any U.S.-bound components meet regulatory expectations under 21 CFR Part 820. CE marking applies to EU-bound devices, signifying conformity with European directives. Together, these show that both the workflow and the final device are monitored under recognized international frameworks. For reference, see ISO 13485 overview and the FDA’s Medical Device Quality System Regulation.

Ask for a copy of certificates with registrar contact details and scope definitions. Cross-check ISO certificates on the registrar’s website; confirm FDA registration in the FDA Establishment Registration & Device Listing database; and search CE marks on the Notified Body’s site. Pay attention to scope wording: “manufacture of dental prosthetics” is not the same as “distribution.” Ensure the validity period and scope align with implant workflows. If details are vague, treat that as a red flag.

Compliance is not only about certificates on the wall—it extends to material sourcing, traceability, and workflow discipline. Materials like zirconia discs and implant components must come with certificates of analysis tied to batch numbers. Equally, the lab’s processes—design transfer, case record storage, CAPA handling—should reflect ISO 13485 structure. When materials and processes are both compliant, customers can defend outcomes in audits and reduce liability. As an overseas dental lab, we integrate certification records into case histories so clients always have evidence in hand.

Turnaround depends on two clocks: production (CAD/CAM, sintering, QC) and transit (courier, customs, distance). For routine zirconia implant crowns, expect predictable lab cycles plus 2–5 business days of express shipping, with buffers for customs review and time-zone handoffs. Anchor your plan to service-level data from carriers and align cut-off times with your clinic’s schedule.

Implant-crown-logistics-timeline-china-to-us

Plan production plus express transit. Most clinics see lab build (design → mill → sinter → stain → QC) within a defined window, then UPS Worldwide Express Saver (≈3–5 business days) or FedEx International Priority (≈1–3 business days, lane-dependent) for delivery to the U.S. For current service ranges, see UPS International services and FedEx International Priority. ups.comFedEx

Use a “one-page lane plan” before the first case:

If a lab quotes “next-day ship” on multi-unit implant zirconia, probe for skipped steps (no in-process checks, no post-stain verification) or unstable outsourcing. Ask to see the QC checklist timestamps tied to case IDs and courier manifests. A Sydney clinic we support tried a “rush lane” for eight posterior units: early loads returned in four days but required chairside adjustments on five of eight. After reinstating the second in-process check and locking a pickup at 18:00 CST, the same lane shipped in six days with only one minor adjustment. As a global dental lab, we prefer a transparent six-to-seven-day lane that preserves QC over an optimistic promise that erodes fit and trust.

Price alone never tells the full story. A reliable cost model for implant work balances direct line items with predictable hidden costs. Smart buyers look past the unit fee to total landed cost: case price + shipping + remake rate + urgent handling. Labs that make these drivers transparent create trust; labs that hide them create frustration and unpredictable ROI.

Dental-implant-lab-cost-breakdown

Implant pricing typically has four visible categories—unit cost (crown, abutment, framework), design fees, finishing options (stain, layering), and shipping. Beyond that, check for courier surcharges, scan fees, or “handling” lines. A clear breakdown helps you compare labs on equal terms.

A unit fee 20% below market may look appealing, but if remake rates are high or shipping is inconsistent, chairside time and patient confidence suffer. ROI comes from fewer adjustments and predictable cycles, not the lowest headline price.

Consider a mid-size U.K. distributor that trialed two Chinese labs for 40 zirconia units. Lab A offered £10 less per crown but charged urgency surcharges and had a 15% remake rate. Lab B’s sticker price was higher, but remake was 5% and shipping included. Net cost per usable unit favored Lab B by ~12%.

Common blind spots:

Choosing the right collaboration model is less about labels and more about control, flexibility, and risk tolerance. Implant labs in China can support OEM, ODM, and outsourcing models, but each comes with different degrees of influence over design, delivery, and intellectual property. Understanding these differences helps procurement teams align the lab’s role with their own strategic needs.

Dental-lab-collaboration-models

Flexibility often shows in file handling and prototyping support. A Canadian DSO ran a six-week pilot where the lab adapted its CAM nesting strategy to match the DSO’s abutment library, allowing in-house teams to reuse case files across multiple practices. This saved ~18% design time internally. As a global dental lab, we regularly adjust nesting, tool selection, or shading sequences to match client SOPs, provided changes are documented and repeatable.

Run a small, structured pilot before long-term commitment.

Most outsourcing failures trace back to mismatched expectations, opaque workflows, or weak verification. Reduce risk by aligning communication habits, demanding transparent records (materials, decisions, QC), and running due diligence with clear pass/fail gates before volume work begins. Treat risk management as a process, not a one-time checklist; frameworks like ISO 14971 (risk management for medical devices) help you structure it.

Implant-outsourcing-risk-checklist

Risk rises when teams lack a single case thread, clear response SLAs, or shared vocabulary. Watch for soft language around “almost ready,” inconsistent time-stamp habits, or design notes buried in emails.

Early warning signs often appear in documents. Use the table below to triage signals.

| Signal you see | What it may mean | Your move |

|---|---|---|

| No batch/lot on zirconia or screws | Weak traceability | Request COA + lot photos stored with the case ID |

| Design decisions missing from records | Risk of silent rework | Require a change log and signoffs in the case thread |

| “All-in” pricing with vague surcharges | Hidden landed cost | Ask for a cost sheet separating unit, shipping, rush, remake |

| Variable ship promises without cut-offs | Capacity/bottleneck gaps | Set fixed pickup windows and escalation paths |

| Refusal to share QC checklist | Steps being skipped | Pilot with mandatory pre-ship QC photos and timestamps |

Run a short pilot with pass/fail criteria before scale.

As an overseas dental lab, we keep pilots small but rigorous, so both sides learn quickly with minimal patient risk.

When procurement teams evaluate partners, independent voices often provide the most credible insights. Reviews, testimonials, and case feedback help validate claims about fit, finish, and long-term outcomes. The key is to look for patterns across multiple clinics and labs rather than focusing on a single story.

Dental-implant-lab-testimonials

Authentic feedback can be found through:

Recurring themes reported by clinics and DSOs often cluster around three dimensions:

| Feedback Category | Common Positive Signals | Red Flags to Watch |

|---|---|---|

| Fit | Minimal chairside adjustment, consistent occlusion | Frequent need for grinding, passive fit failures |

| Finish | Shade matching and polish praised | Over-polishing, surface roughness, mismatched translucency |

| Success | Low remake rates (<3%), stable long-term follow-up | High fracture rates, repeated screw loosening |

For instance, one U.S. clinic shared that after partnering with a Chinese lab for 18 months, their average adjustment time dropped by 22%. But another clinic reported variable translucency when rush orders bypassed normal QC — showing the need to filter both good and bad feedback through context.

Choosing a dental implant lab in China should feel disciplined, not risky. Prioritize partners who prove quality with measured remake rates, traceable QC, and genuine parts; who fit your digital stack and document workflows; who show valid ISO 13485 and market-specific compliance; and who publish realistic turnaround plans. Value comes from transparent total cost, not the lowest sticker price. Start with a small, metric-driven pilot and check third-party feedback for pattern, not anecdotes. As an overseas dental lab, our role is to collaborate—align files, timing, and records—so your team gets predictable seats and fewer surprises. That is how cross-border partnerships compound into trust.