Selecting a dental lab for OEM implant projects is not about outsourcing routine cases—it is about building a strategic partnership. True OEM readiness depends on engineering integration, certified quality systems, and structured workflows that guarantee repeatability, traceability, and long-term value.

For buyers launching new product lines, scaling implant production, or shifting from in-house manufacturing, the lab’s role goes far beyond unit cost. Critical evaluation points include control of digital assets, transparency of QA documentation, scalability under demand pressure, and the ability to support design iterations during pilot validation.

Key factors to examine include:

By focusing on these elements, decision-makers can identify OEM dental lab partners that deliver not only products, but also lasting technical success and commercial stability.

A dental lab can only be considered OEM-capable when it goes beyond routine case production and builds a repeatable system for engineering, customization, and scale. The real difference lies in whether the lab can design, document, and reproduce implant products under controlled processes, rather than just fabricating restorations on demand. Buyers looking for OEM partners should focus on the technical depth and workflow maturity that separate these labs from standard service providers.

OEM-Dental-Lab-Implant-Capability

OEM labs are structured to deliver repeatability and scalability. While a standard lab focuses on single cases, an OEM-capable lab develops controlled workflows:

This difference makes OEM labs suitable for businesses that need stable long-term supply chains rather than one-off restorations.

OEM-capable labs are expected to handle advanced customization beyond aesthetic veneers or single-unit crowns. Typical implant OEM projects include:

True OEM labs engage engineering support at the concept stage, not just in production. Early technical involvement ensures:

For example, in one OEM partnership with a European distributor, early CAD alignment between scan bodies and custom Ti-Bases prevented recurring fit errors and saved months of downstream rework.

Embedding engineering early is the difference between a vendor and a true OEM collaborator.

In summary, a lab that can formalize processes, support deep customization, and bring engineering upstream is what defines OEM capability. For buyers, recognizing these elements means selecting a partner ready to grow with their product line, not just fulfill orders.

The engineering strength of an OEM dental lab is reflected in how well it integrates digital workflows, material science, and implant system compatibility into a repeatable process. A capable partner does not just “make parts,” but ensures each design can be scaled, validated, and adapted to complex implant cases. Buyers should look at material range, CAD/CAM integration, and the ability to support advanced workflows like guided surgery.

Dental-Lab-OEM-Engineering-Capability

Labs positioned as OEM partners should demonstrate broad compatibility with major implant platforms and advanced restorative materials.

This ensures OEM buyers are not locked into narrow options and can scale product lines across multiple clinical markets.

Strong OEM labs integrate CAD/CAM platforms directly with engineering oversight. Evaluating them involves three steps:

Without these checks, even the best CAD designs may fail in production.

Beyond single-unit restorations, an OEM-capable lab should prove experience in complex workflows such as guided surgery or full-arch solutions. This means coordinating between digital implant planning, custom abutments, and surgical kits. In one case with a North American DSO, early validation of guide sleeve tolerances prevented mismatch during surgery and built long-term trust. OEM buyers benefit most when labs can bridge engineering design with surgical execution, not just lab-side production.

Selecting an OEM lab with these engineering and technical benchmarks ensures scalability and reliability. For buyers, it’s a signal that the partner is not only production-ready but also capable of supporting innovation pipelines in digital implantology.

OEM dental partnerships succeed when they operate like structured projects rather than transactional orders. The defining elements are clear approval checkpoints, consistent communication, and responsive technical support. A lab that formalizes these workflows can reduce errors, accelerate timelines, and provide buyers with confidence in long-term collaboration.

Dental-Lab-OEM-Collaboration-Workflow

OEM projects require documented checkpoints that align both buyer and lab teams. Typical stages include initial CAD review, prototype validation, and final sign-off. Each milestone should be supported with digital files and QA records, ensuring traceability. Without this formalized approval loop, misalignments can easily escalate into delays or costly rework.

Efficient OEM labs assign one central contact—often a project manager or account specialist—to coordinate between engineering, production, and logistics. This prevents communication gaps and makes troubleshooting faster. Buyers should confirm whether the lab offers:

These mechanisms make a lab feel like an extension of the buyer’s own team.

In OEM partnerships, technical questions arise frequently—ranging from abutment geometry to material testing reports. The difference between a vendor and a partner is measured by responsiveness. Labs with structured support often reply within 24 hours, provide annotated CAD feedback, and escalate unresolved issues to engineering quickly. For example, in one OEM program with an Asia-Pacific distributor, rapid clarification on zirconia sintering parameters avoided a shipment delay, reinforcing confidence in the collaboration.

Strong OEM workflows mean buyers don’t just receive products—they receive a process that reduces risk and builds trust. When collaboration is structured and communication transparent, OEM partnerships move beyond outsourcing and become long-term joint ventures.

An OEM-capable dental lab demonstrates readiness through formal quality systems and internationally recognized certifications. These are not optional add-ons but structural assurances that every implant component can be reproduced with the same precision, traceability, and safety standards. For buyers, certifications like ISO 13485 or DAMAS serve as clear signals that the lab can sustain consistent output at scale.

Dental-Lab-OEM-Quality-Certification

OEM buyers should first confirm whether the lab operates under globally recognized frameworks.

These certifications show that the lab is not only technically skilled but also formally accountable to international quality rules.

Beyond certifications, a true OEM lab enforces consistency with batch-level control and product traceability. Every lot of abutments, Ti-Bases, or zirconia frameworks should be:

In one OEM project with a European implant distributor, traceability records proved critical when a supplier batch of zirconia needed recall—the lab isolated affected units within 24 hours, minimizing disruption for the client’s downstream clinics. This level of control defines OEM maturity.

A reliable OEM lab delivers documentation as part of the product, not as an afterthought. Buyers should expect:

Such documentation makes the supply chain auditable and gives buyers assurance that production is controlled, not improvised.

Quality systems and certifications are the foundation of OEM partnerships. They convert trust into verifiable proof and give buyers confidence that scale will not compromise reliability.

In OEM partnerships, intellectual property and production assets often matter as much as the physical restorations themselves. A capable lab sets clear rules on who owns CAD files, molds, and tooling to avoid disputes later. Buyers should evaluate whether the lab provides transparent agreements that protect proprietary data and guarantee continuity, even if partnerships change.

Dental-Lab-OEM-Digital-File-Ownership

The starting point in any OEM evaluation is understanding asset control. Some labs retain ownership of CAD design files or proprietary molds, while others transfer them fully to the buyer. OEM buyers should confirm:

Without clarity, buyers risk dependency that may later complicate scaling or supplier diversification.

OEM-ready labs provide explicit agreements to protect confidential data. These often cover:

These agreements protect both sides and ensure that collaborative innovation, such as custom Ti-Base geometries or proprietary scan body designs, cannot be reused without consent.

Supplier changes are common in long-term manufacturing. The real test of OEM maturity is whether a lab can provide exit-friendly processes. This includes handing over CAD libraries, releasing molds, and providing full documentation for transition. In one OEM project with a U.S. distributor, a lab’s willingness to transfer validated CAD templates during a supplier switch avoided six months of redevelopment and kept implant kits on the market without disruption.

OEM partnerships are not only about production efficiency but also about protecting business continuity. Transparent ownership and clear transferability clauses signal that a lab is a true long-term partner rather than a dependency trap.

OEM buyers depend on their dental lab not just for precision but also for predictable, scalable supply. A transparent production and delivery system ensures buyers can monitor progress, anticipate timelines, and trust that the lab can handle demand spikes or disruptions. Scalability, combined with clear logistics tracking, is what separates a stable OEM partner from a short-term vendor.

Dental-Lab-OEM-Production-Delivery

Scalability starts with capacity. OEM-ready labs demonstrate:

This ensures buyers are not caught in backlogs when market demand increases unexpectedly.

Transparency means buyers can see where their orders stand. OEM labs often implement:

For instance, in one OEM collaboration with a Middle Eastern distributor, integrated logistics tracking allowed clinics to pre-schedule implant surgeries with confidence, reducing costly cancellations. Such visibility directly translates into customer trust.

Disruptions—whether from material shortages or global shipping delays—are inevitable. OEM-capable labs build resilience by:

Labs that can communicate these measures upfront signal a higher level of professionalism. For buyers, this means smoother supply continuity even when external shocks occur.

Scalable production and transparent delivery systems are the backbone of a reliable OEM partnership. They provide the stability buyers need to plan confidently, even in volatile markets.

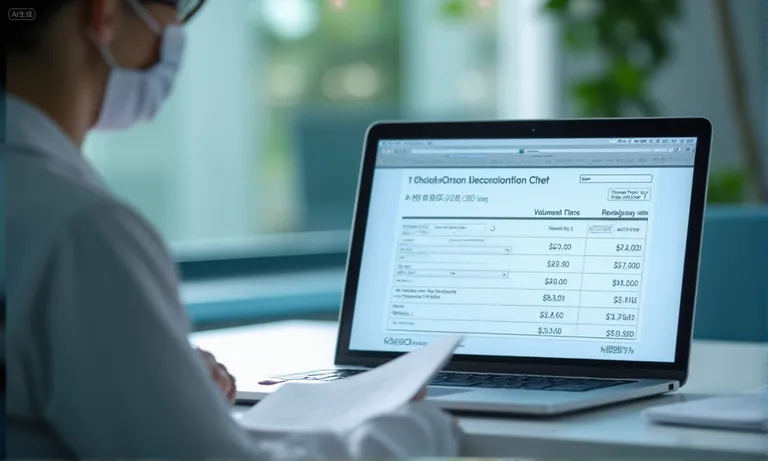

Evaluating the cost of an OEM dental implant partnership requires more than comparing quotes. The real assessment looks at how pricing models align with project scale, whether hidden costs are transparent, and how outsourcing impacts long-term ROI compared to in-house production. A lab that explains its pricing clearly and helps buyers project return demonstrates maturity and reliability.

Dental-Lab-OEM-Pricing-ROI

OEM labs typically structure pricing in three ways:

Buyers should confirm which model is applied and whether it matches their growth strategy.

Transparent OEM labs disclose potential add-ons upfront. Common hidden costs include:

Identifying these in advance prevents budget surprises and builds trust. For example, in one collaboration with a European DSO, pre-agreed remake policies reduced disputes and allowed both sides to focus on scaling rather than cost disputes.

Outsourcing to an OEM lab often reduces capital investment in milling machines, scanners, and QA systems. The ROI comes from:

When calculated over several years, outsourcing often delivers higher ROI than in-house setups, especially for distributors or DSOs scaling across multiple markets.

Clear pricing models and transparent cost structures allow buyers to compare options fairly. When combined with ROI analysis, they turn financial planning from guesswork into strategic decision-making.

Before moving into full OEM production, buyers should require a structured onboarding and validation process. This ensures that technical accuracy, workflow compatibility, and communication routines are proven in a controlled environment. Skipping these steps often leads to costly misalignments once volume ramps up.

Dental-Lab-OEM-Onboarding-Validation

Pilot validation confirms whether the OEM workflow is production-ready. Key steps include:

These steps reveal weaknesses early, before full-scale rollout.

Technical benchmarks provide measurable criteria for go/no-go decisions:

For example, in one OEM onboarding project with a European distributor, pre-launch tolerance checks across three pilot batches reduced later adjustment rates by more than 20%.

Timelines vary, but OEM onboarding usually unfolds in phases. The initial pilot stage may take 4–6 weeks, followed by incremental scaling as benchmarks are met. Transition to full production often takes 8–12 weeks, depending on complexity and order volume. Labs that provide clear Gantt charts or onboarding roadmaps help buyers plan inventory and market launches more confidently.

Onboarding and validation are not formalities—they are risk controls. For OEM buyers, demanding a structured pilot and benchmark-driven onboarding process is the best way to ensure a smooth transition into stable, long-term supply.

Choosing an OEM dental lab partner is about more than product pricing—it is about building a transparent, reliable, and scalable collaboration. A lab that combines engineering depth, certified quality systems, and structured workflows provides not just restorations but long-term value. By securing clear agreements on digital assets, validating production through pilots, and ensuring supply continuity, buyers reduce risk and maximize ROI. Partnering with an overseas dental lab that treats collaboration as a joint venture gives OEM buyers confidence to expand product lines and serve markets with stability and trust.